- Chris R.

- No Comments

- Published: August 12, 2020

- Modified: November 5, 2021

“MoolahNinjas main goal is to help our readers improve their financial lives. We partner with other companies that share that same vision. Some of these links in this post may be from our partners. This is how we make money.”

To make money on stocks, you need to buy shares at a low price and sell them at a high price.

The best way to do this is to invest in a diverse portfolio of low-risk companies that are likely to increase in value over time.

You might not make a lot of money in the short term.

But, the market reliably trends upwards over time, so you’re almost guaranteed to make a profit in the long run.

That might not sound as exciting as “The Wolf of Wall Street”. That’s because investing doesn’t work that way in real life.

Making huge profits in a short amount of time is very unlikely. Even the most successful investors in the world, like Warren Buffet, don’t make money on stocks in the short term.

But, it’s not impossible.

If you buy at the right moment, you can take advantage of a boost in the price of a stock and then sell immediately to make a quick profit.

There are many successful traders who make a lot of money this way. But the risks are higher.

Luckily, you don’t have to wait forever or risk everything to make money on stocks.

By following the advice in this guide, you will be able to make modest gains in the short term or set yourself up with a successful portfolio for long-term stability.

Tip: InvestoRunner.com helps you compare stocks and investments.

In this beginner’s guide on how to invest in stocks, you’ll learn:

Must-Know Market Basics

How to Generate Cash by Trading Stocks

High-Risk and Low-Risk Money-Making Strategies

How to Use the Experts to Your Advantage (and Make Money Fast)

Common Investor Mistakes

How to Start Investing Today

Investing is all about doing the research and gathering the tools you need to make smart trading decisions.

Step 1? Read this article (easy, right?).

By the time you finish, you’ll have everything you need to open a brokerage account and make your first trade.

Are you ready to invest?

You can’t just walk into your local supermarket and buy stock.

To buy stock, you need to place an order on the stock market (also called a stock exchange). The stock market is where stocks are bought and sold.

The stock market functions as an auction. Sellers try to sell their stock for a high “Ask” price, and buyers try to buy stocks for a low “Bid” price.

The job of the stock exchange is to match buyers and sellers.

Nowadays, this is all done electronically, so all you have to do is click a button to buy or sell stocks.

To make money on stocks, you should buy when you think the price is going to go up. When it does, sell it and walk away with your profit.

If you were smart enough to invest $10k in Apple 10 years ago, you’d have about $50k today. Not bad!

The market is open daily during normal business hours. You can easily buy and sell stocks using an online brokerage account (you can start your own account for free in minutes—we’ll tell you how below).

The Basics: Making Money on Stocks

What is stock, anyway?

When a company “goes public” on the stock market, it agrees to sell the ownership of the company to investors (like you). The individual units of ownership of a company are called shares.

The sum of all the shares of a company is the company’s stock.

So, when you trade on the stock market, you’re actually buying and selling individual shares.

When you buy shares of a company, you will become a partial owner, and the directors of the company will be obligated to work for you (they won’t do your laundry, but they’ll try to make you more money!).

If you think a company is going to do well, you can buy part of it and share its success (or failure).

This is called investing.

The Two Factors Beginner Traders Must Know

Your success at making money in stock depends on two things:

- The success of your companies: The better your companies do, the more money you will make.

- Timing: Knowing when to buy, sell, and hold is the key to managing your investments.

In order to know which companies to invest in and when to execute your trades, you need to do research.

First, you need to research companies to find the ones that have the best chance of success.

Once you’ve made your choices and bought stock, you need to monitor your companies regularly to make sure they are making smart decisions that will improve the stock price.

As you can imagine, all of this research can be a lot of work. Luckily, there are ways you can make money on stocks without doing a lot of research.

- Hire a stockbroker: Don’t know how to make money in the stock market? Go to your bank or an investment firm and hire someone to manage your portfolio for you. It’s their full-time job to make stock picks and track data, giving you a better chance to succeed. But, you’ll need to pay brokerage fees, which can be costly.

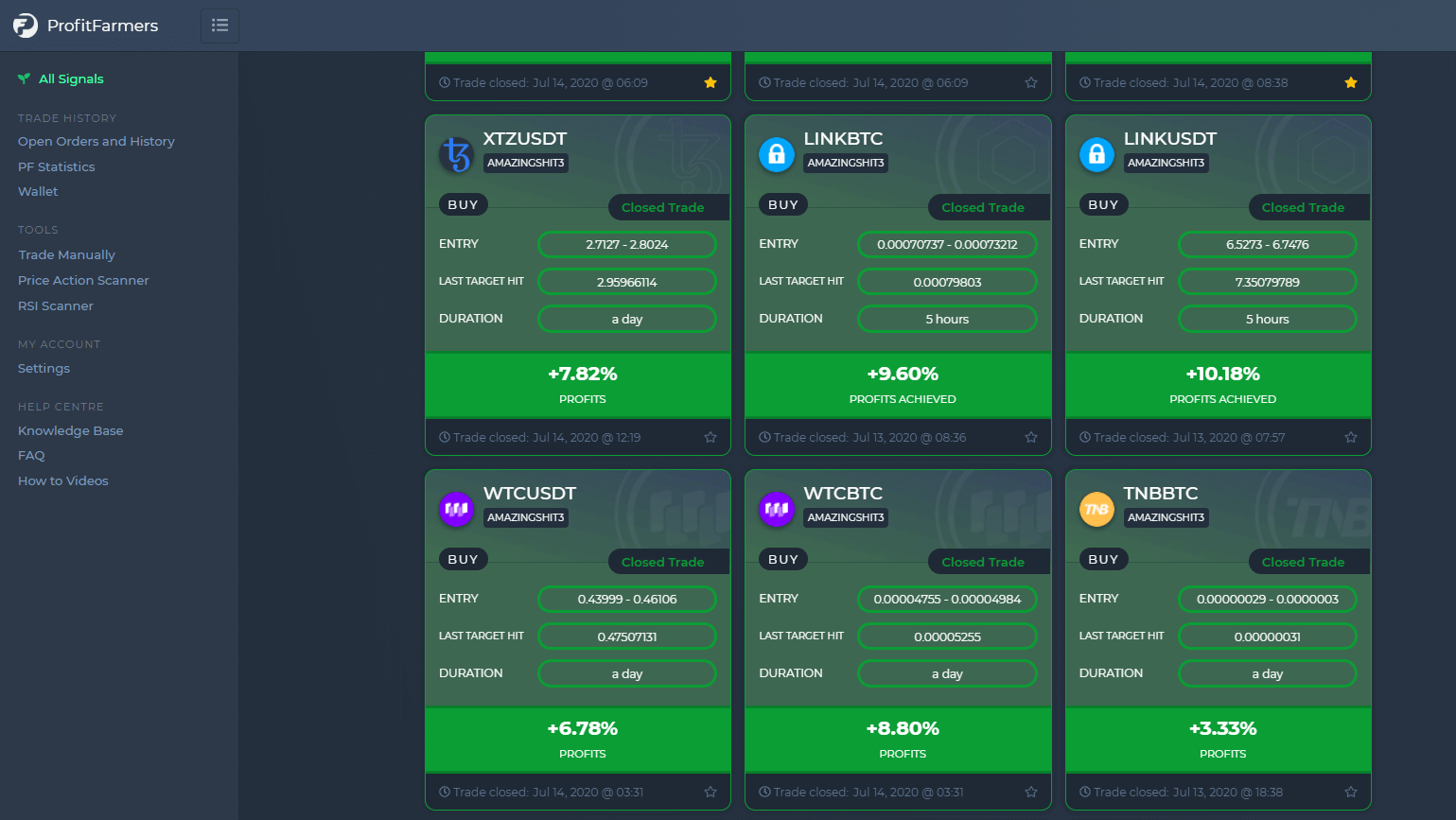

- Use trading signals: Trading signals tell you when to buy and sell stock at the right moments to make decent gains without risking a lot of money. The trading data is based on algorithms and expert research that do the hard work for you. For example, We use trading signals to trade cryptocurrency at profitfarmers.com. Learn more about making quick cash with trading signals in our full review.

- Invest in your passion: You probably already know a lot of good companies to invest in. For example, if you love cars, you might be an expert on Ford, Fiat, BMW, and more. Use what you know to invest in companies you love. This will also make it much more enjoyable to do research and follow the news.

How to Make Money on Stocks: How to Trade Stocks and Make a Profit

There are several ways to make money on stocks.

Some are slow and steady (low-risk), and others are fast-paced and full of action (high-risk).

We’ve separated our money-making strategies into high-risk and low-risk sections to make it easier for you to learn how to make money in the stock market.

Low-Risk Strategies

Low-risk strategies involve buying stock and holding long-term. This is considered to be the smartest way to invest in stock because the market always goes up over time. If you have a diversified portfolio, you will almost definitely make money.

Index Funds

Investing in index funds might be the smartest way to invest.

An index is a list of the top companies in the stock market or within a sector.

When you invest in an index fund, you are investing in all of these companies at once.

That means you’re investing in the strongest companies in the world, PLUS you’re getting automatic diversification.

It gets even better.

Because index funds are passive, low-risk investments, you will pay very low management fees (less than 0.5%) and very few taxes.

And, index funds are virtually guaranteed to make you a profit of 5% or more per year.

Some examples of index funds include:

Index funds are traded in shares. Open a brokerage account that trades index funds to start investing (we’ll give you some options below!).

Mutual Funds

Mutual funds are similar to index funds, but they are much less passive.

When you invest in a mutual fund, you are investing in a diverse list of companies.

But, this list can change without any action on your part. The managers of the fund will buy and sell stock (with your money) to try to maximize profits.

Mutual fund investments are riskier but have the potential for bigger gains. Some achieve annual gains of nearly 20%.

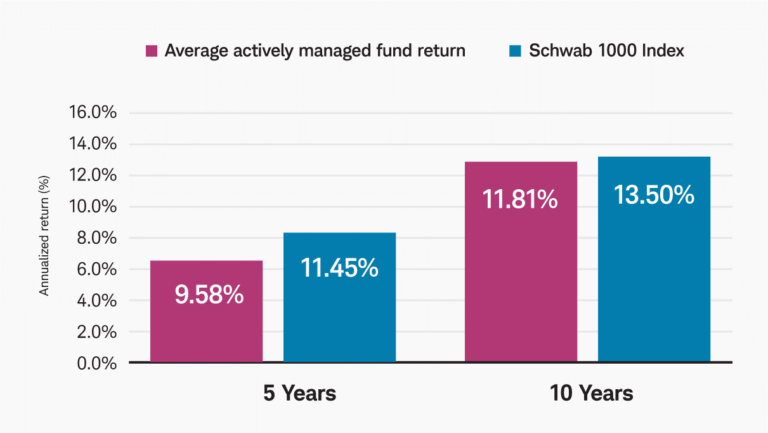

But in the long term, index funds almost always prove to be more profitable. Take a look at how the average actively managed fund (mutual fund) compared to the Schwab index fund over time:

You can buy and trade mutual funds in the same way as you can index funds. There are thousands of mutual funds to choose from. Here are some top performers:

Hire a Stockbroker

When you invest in mutual funds or index funds, you are not involved in the decision-making process at all. Managers do all the work for you.

If you’d like to do some of your own research and be more involved while keeping your risk low, you can hire a stockbroker to manage your portfolio.

Stockbrokers are investment experts who help you pick the best stocks.

They’ll buy and sell what you want when you want. If you get a hot tip on a company you know is going to do well, just call your broker and they’ll buy the stock.

They’ll also keep an eye on your portfolio and inform you when they think is a good time to buy and sell.

You can customize your relationship with your broker to be passive or active.

Hiring a broker is a great way to lower your risk while playing an active role in your investments.

But, you will need to pay fees and commissions to your broker. For example, brokers charge an average of $150 per transaction (trade). This is compared to $0-$10 per trade if you use an online brokerage account.

To find a stockbroker, talk to your bank or search for an investment firm in your local area.

To trade using an online brokerage account, try one of theses platforms:

Etoro

Etoro is a social trading network that allows users to trade, follow other investors, and copy the trades of successful investors. With a free Etoro account, you can trade cryptocurrency, stocks, and commodities.

Interactive Brokers

One of the biggest brokerage sites in the world, Interactive Brokers provides unprecedented access to global markets. With an IB account, you can invest all over the world regardless of your country of residence.

Charles Schwab

Schwab makes trading easy with its host of tools and easy-to-use website and app. Schwab allows you to trade a wide variety of stocks and commodities and gives you access to many international markets. Opening a Schwab account and trading stocks is free.

Buy Safe Stocks

If you want to buy individual stocks but don’t like the idea of paying fees and commissions to a stockbroker, you can lower your risk by investing in safe companies.

These companies are reliable institutions that are likely to grow over time. Safe companies to invest in include:

These companies aren’t going anywhere. They’re solid parts of the global economy, and they’re highly likely to stay that way.

They are almost guaranteed to continue to grow, providing you with steady gains over time. Take a look at Disney’s growth:

High-Risk Strategies

High-risk strategies involve choosing risky companies or buying and selling often to maximize profit. These strategies require you to make predictions and take chances. There’s the potential for huge gains and losses, so we only recommend making high-risk investments with supplemental income.

Buy Individual Stocks

Do you have what it takes to pick winners from the thousands of companies listed on the stock market?

If so, you can make a lot of money, very fast.

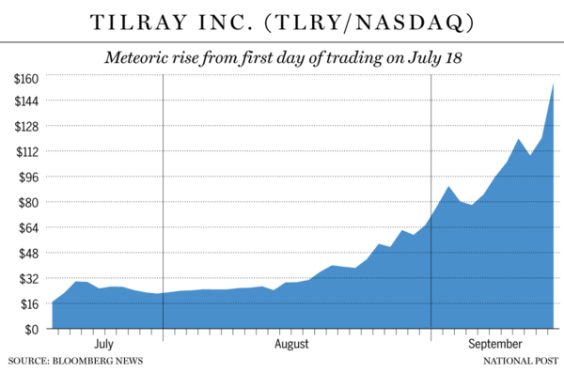

For example, the stock of the company Tilray, Inc. went up 800% in two months after receiving some good news.

Can you make a lot of money in stocks? Well, If you had purchased 100 shares before the boost, you would have made over $11,000 in just 2 months.

Gains like this happen every day on the stock market.

But, making the right stock picks is not easy. In fact, only about 4% of companies on the market actually generate wealth.

Still, if you do your research and time your trades right, you might find a stock that could make you rich.

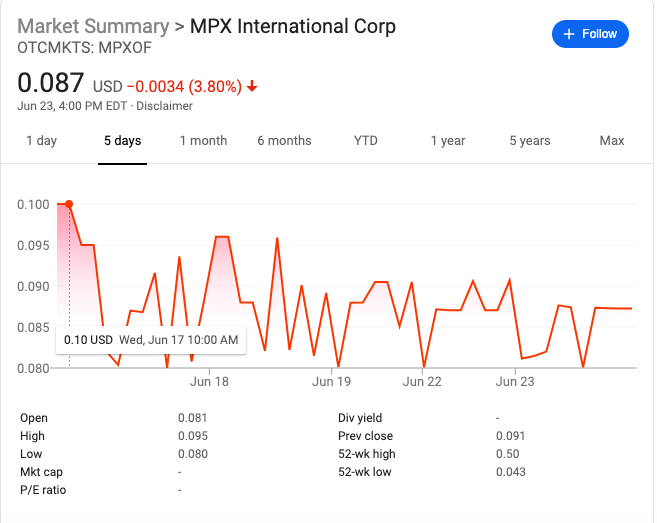

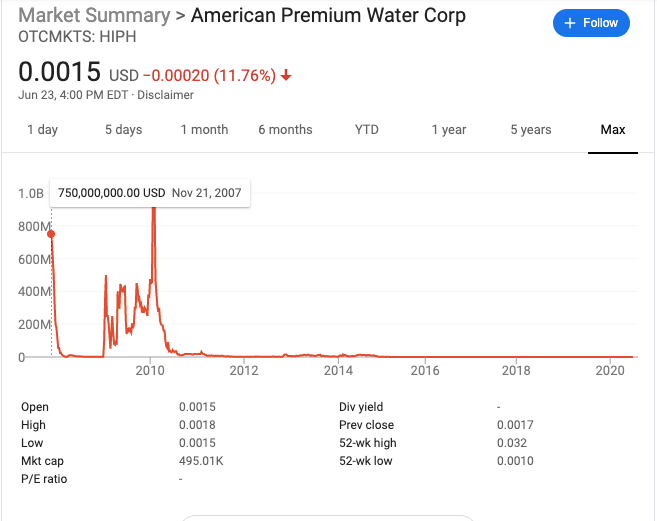

Trade Penny Stocks

What are penny stocks?

Penny stocks are companies that trade for $5.00 or less per share.

These stocks are attractive because they offer rock-bottom prices on new companies.

Imagine buying 10,000 shares of a new company for $0.10 per share. If the company becomes successful and the stock price goes up to $5.00, you will have made $50,000 from a $1000 investment.

These success stories happen!

But, they are rare, and penny stocks are incredibly risky.

In fact, their failure rate is nearly 100%!

The best way to make money on penny stocks is to buy them and sell them as soon as they go up. If you hold, you’ll probably lose your investment.

Many penny stock traders are switching to cryptocurrency trading as the risks and rewards are very similar. Thousands of new crypto companies are entering the market, and the potential for quick gains is making some traders very happy. Check out our review of profitfarmers.com to learn more about trading crypto.

Day Trade

Day trading is the high-stakes profession of making quick trades for quick profits.

Day traders buy and sell stock every day.

Some days, they make thousands. Some days, they lose thousands.

It’s a stressful job, but it can be rewarding.

If you don’t want to day trade professionally, you can try it with just a few companies to see if you can make some cash.

Buy stocks when the market opens, monitor the price throughout the day, and sell when it goes higher than your buying price.

Of course, the value of the stock might fall, too.

If you do your research, you can make some quick cash day trading. If you have some extra income, it can also be a thrilling hobby!

Is There a Middle Ground Between High and Low Stakes Trading?

Yes. There are a few ways that you can mitigate your risk, making it easier to make money on stocks in the short term.

- Do the research and stay invested: Doing a lot of research and holding your stocks will significantly lower your risk, but it can be time-consuming.

- Follow trading signals: Using trading signals (like we do on profitfarmers.com) puts expert research and million-dollar algorithms to work for you. Trading signals tell you what to buy and when to buy. All you have to do is watch your money grow.

Investing vs. Trading: What’s the Difference?

Investing and trading are two different ways to “play” the stock market.

Investing

Investing is passive. When you invest in stocks, you buy reliable companies and watch how they perform. You might adjust your portfolio once each year, or you might not.

Trading

Trading is active. When you trade, you update your portfolio often, buying low and selling high to try to maximize your gains.

While trading can be more fun, it’s not always the most profitable.

A study in the Journal of Finance found that people who trade more frequently see fewer returns.

Common Stock Trading Mistakes

Most investors lose thousands of dollars making these mistakes before they ever see a profit.

Trading Individual Stocks without Research

Trading individual stocks can be fun and rewarding.

But if you don’t do thorough research, you’re better off playing roulette.

One study found that investing in individual stocks averaged gains of less than 2% compared to gains of over 8% for index funds.

For less than 2% gains… is it even worth investing?

To make more money, you need to be properly informed.

Start by researching a company’s:

When you become an expert in a company, you’ll know when to buy and sell its stock.

Failing to Diversify your Portfolio

Some of your stocks are going to fail.

It’s inevitable.

Diversifying your portfolio (buying stock from a variety of companies in different industries) ensures that your successful buys will overcome your failures.

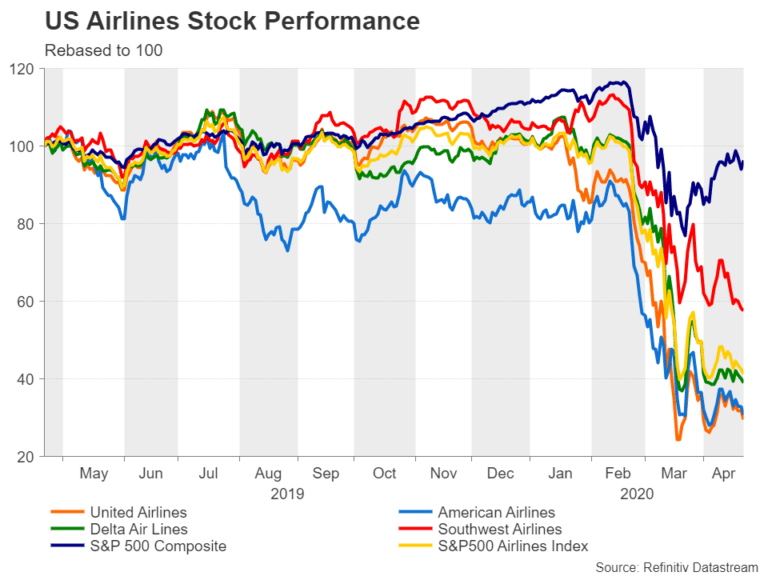

Just take a look at the airline industry compared to the S&P 500 index.

The market has rebounded, but the airlines have not. A diversified portfolio protects against industry slumps and unforeseen company failures.

Assuming You Are an Expert

Even the smartest investors in the world cannot predict the market with any degree of certainty.

No one has ever been able to do it.

The market will always involve risk, chance, and luck. Investors who forget this take too many risks and lose everything!

Buying and Selling Too Much

Fear of missing out (FOMO) and post-trade regret cause investors to buy and sell often.

For example, you might sell a stock on a downward trend. But then, the next day, the stock goes up. You feel regret, so you buy back at a higher price (and lose money). A week later, the stock drops, causing you to lose even more.

If you had just held the stock, you would have lost much less money!

Buying and selling frequently = fewer gains.

Holding Penny Stocks

Hoping for that magic moment when your penny stock soars can cause you to hold onto it for far too long.

But the statistics clearly show that almost all penny stocks eventually hit zero.

If your penny stock isn’t showing signs of life, get out before it’s too late.

Getting Started: How to Invest in the Stock Market

This step-by-step guide will help you start investing and making money in stocks quickly.

For a more in-depth guide to getting started in the stock market, read our complete guide on how to invest in the stock market.

1. Contact a broker or investment firm

Head to your bank and ask about investing options. You might have a broker available to you already without even knowing. If not, look up local investment firms and go for a consultation (usually free).

Or

1. Open an account on a trading platform

Opening your own brokerage account is easy. You can trade stocks, index funds, mutual funds, and more from your phone or computer with a click. Most platforms include great tracking, management, and research tools too.

Check out our favorite investment platforms in the next section.

2. Do your Research

Choose a few companies you’re passionate about and dig into the research. If they look like solid investments, add them to your list of potential buys.

Remember to research the following aspects of each company:

- History

- Leadership

- Financials

- Products/Services

- News

3. Start building your portfolio

Now for the fun part. Start trading and tracking your earnings.

Make sure to mix the companies you’re passionate about with some safe bets to mitigate your risk and diversify your holdings.

The Best Platforms for Making Money on Stocks

These are some of the best online stock trading platforms for making quick, easy, and low-cost trades in markets around the world.

To get started, just sign up for an account and prove your identity. Then, you’ll be able to add money to your account and trade stocks with a click.

FAQ

Beginners make money on the stock market by employing low-risk strategies like investing in index funds, ETFs, and mutual funds. This is the best way to start generating income and learn how to make money in stocks.

You can get rich in the stock market, but it will take time. If you invest $100k into an index fund today, you would have a million dollars in about 20 years.

If you get lucky with an individual stock, you could make 1000% on your investment in a few days or months, but this is extremely unlikely.

The best way to get rich in the stock market is to invest a portion of your income each month for a few decades.

The best stocks to buy are reliable companies with great products, solid financials, and a history of high performance. Highly successful companies are likely to continue to succeed. Some of the best companies include:

- Amazon (AMZN)

- Apple (APPL)

- Procter & Gamble (PG)

- Disney (DIS)

- Starbucks (SBUX)

There is no difference between buying cheap or expensive stocks. You gain or lose money based on the percentage of growth and not the number of shares you hold.

However, it is not recommended to buy “penny stocks” (companies valued at less than $5.00) because these companies usually fail.

Are You Ready to Make Money on Stocks?

It’s never been easier to make money on stocks.

By using online resources for research and trading, you can make smart stock picks and start earning money in no time.

To lower your risk, we recommend doing lots of research or investing with expert assistance.

One way to surpass the research and start making money fast is to learn about trading signals at ProfitFarmers.

See how you can watch your investments grow by 20% per month when you trade with the help of expert analysts and algorithms.

Some final advice for making money on stocks:

For reliable gains, choose low-risk strategies.

But, if you have some extra cash and a gut feeling…pick some stocks and have fun!

You never know, you could get lucky!